infrastructure investment and jobs act tax provisions

5376 Build Back Better bill the Infrastructure Act includes several tax-related provi See more. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy.

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Miller Kaplan

Active transportation infrastructure investment program.

. This Act provides monumental investments to. Although most of the tax provisions are expected to be included in the pending HR. 1-14- 2022 White House Memo to Congress on 60 Days of Implementation.

Tax Provisions in the Infrastructure Investment and Jobs Act On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR. 3684 the Infrastructure Investment and Jobs Act the Infrastructure Act. Infrastructure Investment and Jobs Act.

Roads bridges and major projects. November 5 2021 Download pdf 2360 KB The US. 5 Infrastructure Investment and Jobs Act.

The Infrastructure Investment and Jobs Act includes tax provisions youll want to know about November 16 2021 Share. 3684 the Infrastructure Investment and Jobs Act The vote was 228 to. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known.

15 2021 presents a number of issues for taxpayers to consider. On November 15 in a bipartisan ceremony President Biden signed into law HR. The act first passed by the.

State funding provided by Senate Bill 1 SB 1 and Federal funding through the Infrastructure Investment and Jobs Act IIJA represent landmark. Almost three months after it passed the US. Listen to our interview with Rep.

Tax-Related Provisions in the Infrastructure Investment and Jobs Act By. Apr 04 2022 President Biden signed the bipartisan 12 trillion Infrastructure Investment and Jobs Act IIJA into law on Nov. The Infrastructure Investment and Jobs Act signed by the President on Nov.

3684 by a vote of 228-206 with the. The Infrastructure Investment and Jobs Act includes tax-related provisions youll want to know about November 11 2021 November 22 2021 Kim Paskal Almost three months. Highway cost allocation study.

Todd Schanel CFA CPA CFP on November 11 2021 Almost three months after it passed the US. Almost three months after it passed the US. The Infrastructure Investment and Jobs Act will end the Employee Retention Tax Credit early and create new workforce development grant programs and industry-specific.

The Infrastructure Investment and Jobs Act will deliver long overdue historic investments in rebuilding Americas infrastructure and public transit while creating millions of. Among other provisions this bill provides new funding for infrastructure projects including for. Apply to Tax Manager Implementation Specialist Payroll Specialist and more.

The enactment of the bipartisan Infrastructure Investment and Jobs Act will deliver long overdue historic investments to rebuild Americas infrastructure and public transit. House of Representatives tonight passed HR. On November 15 in a bipartisan ceremony President Biden signed into law HR.

3684 the Infrastructure Investment and Jobs Act the Infrastructure Act. Almost three months after it passed the US. 6 b TABLE OFCONTENTSThe table of contents for 7 this Act is as follows.

TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec. Infrastructure Investment and Jobs Act Resource Page. Tax-related provisions in the Infrastructure Investment and Jobs Act.

Biden Infrastructure Plan American Jobs Plan Tax Foundation

Digging Into The Bipartisan Infrastructure Framework What S Important For Ag

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About

Biden Signs Infrastructure Bill Into Law Ans Nuclear Newswire

Infrastructure Investment And Jobs Act Iija Implementation Resources

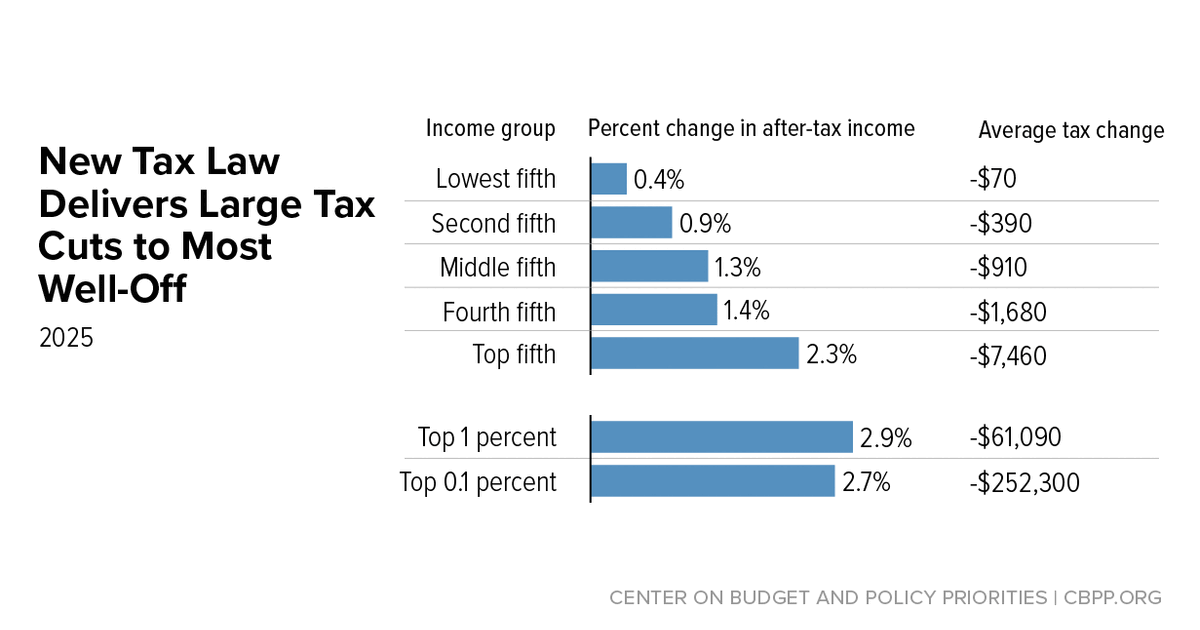

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

Myths And Facts Infrastructure Investment Jobs Act

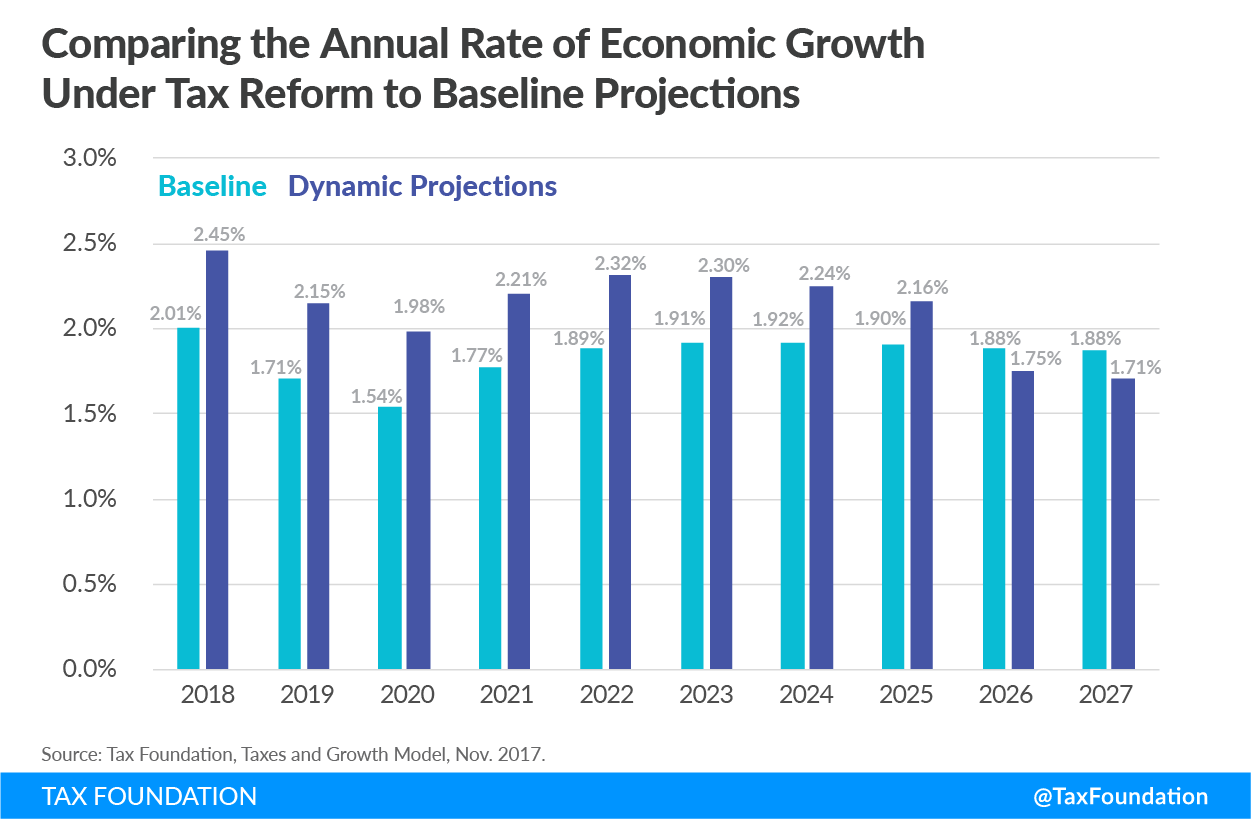

The Numbers Are In Trump S Tax Cuts Paid Off The Heritage Foundation

Who Gets A Tax Cut Under The Tax Cuts And Jobs Act Tax Foundation

Key Hydrogen Provisions Of The Bi Partisan Infrastructure Plan

How The Tcja Tax Law Affects Your Personal Finances

Two Things Crypto Investors Should Know About The Infrastructure Bill Nextadvisor With Time

The Infrastructure Investment Jobs Act Includes Tax Related Provisions You Ll Want To Know About Jones Roth Cpas Business Advisors

Infrastructure Investment And Jobs Act Ey Us

Proposed Estate Tax Changes Build Back Better Act Phoenix Tucson Az

Coin Center Sues Irs For Unconstitutional Tax Reporting Rules Blockchain News

Infrastructure Investment Jobs Act Iannuzzi Manetta

The Infrastructure Investment And Jobs Act S Attack On Crypto Questioning The Rationale For The Cryptocurrency Provisions Cato Institute

Full Details And Analysis Tax Cuts And Jobs Act Tax Foundation